KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

Meet with a liaison officer who will answer tax-related questions, discuss common errors, and bookkeeping best practices. Excise taxes, duties, and levies. Customs, excise taxes and duties, fuel charge, air travellers' security charge, and cannabis duty. Charities and giving.

COMMERCIAL TAX OFFICER FEBRUARY 2,2015 FULL SOLVED PAPER EXAMCHOICES.IN

Review and evaluate commercial or industrial development proposals and provide advice on procedures and requirements for government approval. Conduct surveys and analyze data on the buying habits and preferences of wholesale or retail consumers. Evaluate customer service and store environments. Conduct research on consumers, competitors and the.

HemalathaBC , COMMERCIAL TAX OFFICER (Rank 29, KAS 2017) mock interview at INSPIRO IAS KAS YouTube

Review income tax returns, monitor tax-deductible expenses, and issue business permits and licenses as and when required. Manage and improve internal tax audit capabilities to identify tax exposures and compliance risks before external audits take place. Maintain the company's tax database, update tax rates, and correct data errors to ensure.

State Tax Tax OfficerCTOPrevious year questions and answersKerala PSCPart

Business and Tax Enforcement is a vital part of the IRS. We have opportunities for individuals interested in applying their analytical and investigative skills to educate customers on meeting their tax responsibilities while enforcing the tax laws. If you do join us you won't be disappointed with the many benefits we offer, the opportunities for advancement, or the dedicated professionals.

Timewell Technics Pvt. Ltd. v. Commissioner of C. Ex., Rajkot Indian Law Portal

How much does a Commercial Tax Officer make? As of Apr 14, 2024, the average annual pay for a Commercial Tax Officer in the United States is $102,331 a year. Just in case you need a simple salary calculator, that works out to be approximately $49.20 an hour. This is the equivalent of $1,967/week or $8,527/month.

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

2024-04-02. The Canada Revenue Agency administers tax laws for the government, providing contacts, services, and information related to payments, taxes, and benefits for individuals and businesses.

Tax Officer Exam 2023 2024 EduVark

Deloitte's Chief Tax Officer Program is here to help rising and established tax leaders successfully take on new challenges and seize opportunities that come from change and uncertainty. We leverage our deep tax knowledge, multidisciplinary business experience, and vast resources to empower, connect, and inform tax executives in distinct and.

OSSC ACTO Answer Key 2019 OUT Download Assistant Commercial Tax Officer

a bank. a corporation that is authorized under the laws of Canada or a province to carry on in Canada the business of offering to the public its services as a trustee. a person whose principal business is as a trader or dealer in, or as a broker or salesperson of, financial instruments or money. a credit union.

Akshar Shah tax Officer) LAKSH Career Academy

Aggrieved by the said action of the Commercial Tax Officer, the appellants filed Writ Petitions 1195 to 1198 of 1975 and 3931, 3944 and 4929 of 1975 in the High Court of Andhra Pradesh challenging the said notices which, as already stated, were dismissed by the High Court. 3. The appellant in Appeal 693 of 1976 is a firm which is a licensed.

Tax Department conducts searches in Tamil Nadu Here is a complete guide

A tax accountant plays a vital role in preparing and submitting tax forms. Additionally, a tax accountant analyzes financial information and assist all departments are well-informed of the current best practices in the field of accounting. A tax accountant is valuable to the accounting and finance department as they have formal education and.

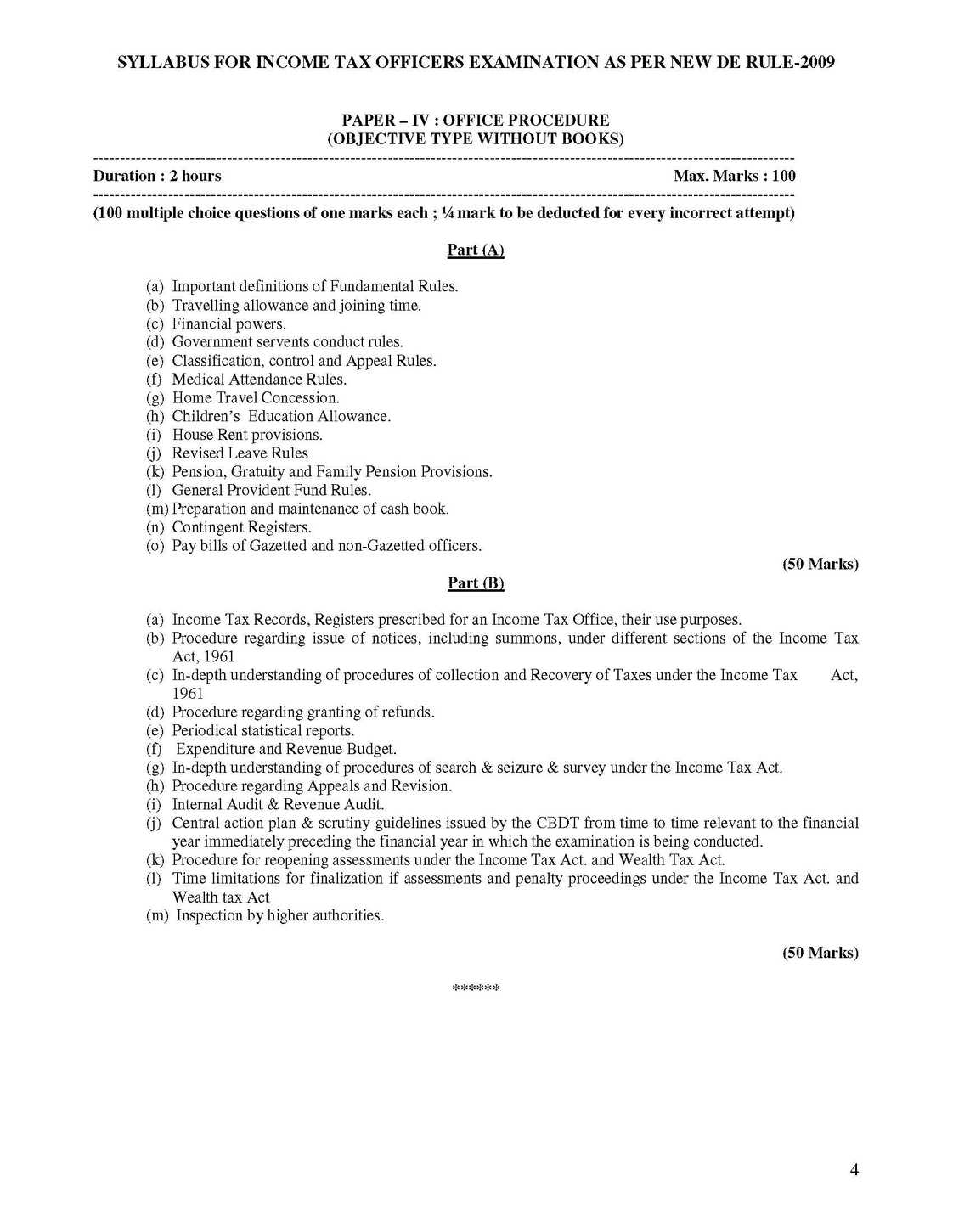

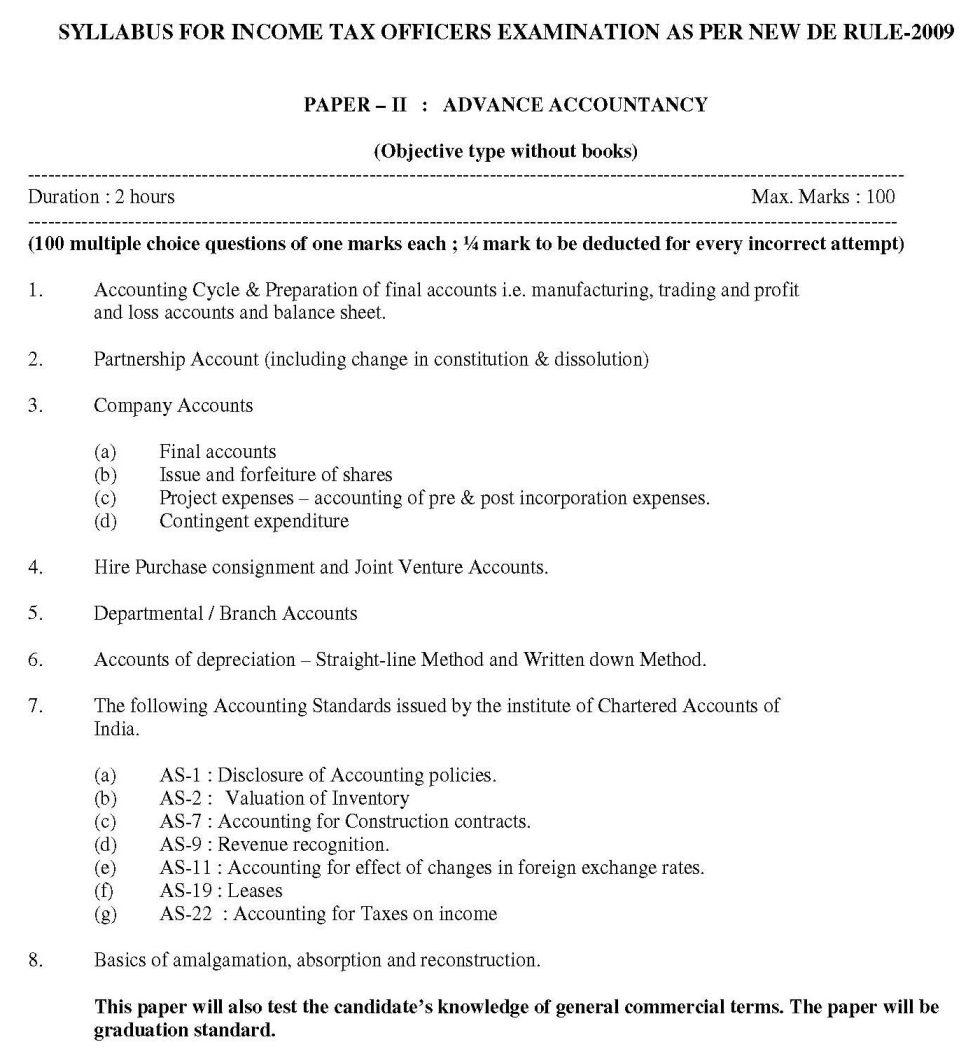

Syllabus of Tax Officer for Preparation 2023 2024 EduVark

Withholding tax on passive income of non-residents. The ITA imposes withholding tax at a rate of 25 per cent on the gross amount of certain payments made by a resident of Canada to a non-resident, including management fees, dividends, rents and royalties. This rate may be reduced pursuant to an applicable tax treaty.

Deputy Commissioner Commercial Tax Officer in ACB Net Hyderabad Overseas News YouTube

What does a Tax Compliance Officer do? Compliance Officers help organizations manage risks and avoid lawsuits by ensuring business operations are performed in compliance with state and federal laws. Compliance Officers are tasked with everything from developing company policies, creating metrics to help track compliance and performing.

UPPSC Topper Ashish Mathur, Commercial Tax Officer Mock Interview YouTube

You can become an income tax inspector by clearing the staff selection commission-combined graduate level (SSC CGL) exam. See below the steps to become an income tax officer through the SSC CGL exam: 1. Get a bachelor's degree. The minimum educational qualification for CGL is a bachelor's degree.

Commercial tax officer goes viral MBCtv YouTube

Mar 11, 2024. KPSC Commercial Tax Officer exam will be held on November 4-5, 2023. The admit card is to be relesaed soon on the official website. A total of 230 vacancies are to be filled out with KPSC Commercial Tax Officer recruitment 2023. The KPSC Commercial Tax Officer notification 2023 has been released on August 28, 2023.

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

Non-resident corporations. A non-resident corporation has to file a T2 return if, at any time in the year, one of the following situations applies:. it carried on business in Canada; it had a taxable capital gain; it disposed of taxable Canadian property, unless the disposition meets all the criteria listed below; This requirement applies even if the corporation claims that any profits or.

KPSC Commercial Tax Officer Syllabus & Exam Pattern 2020 Download

As discussed earlier, commercial tax varies between states across India. These taxes are levied basis the categories that they belong to. The usual rate of commercial tax for most categories is fixed at 12.5%. Despite the variations in the tax rates, commercial tax in India can be classified under four distinct categories: Zero commercial tax