Are You A First Time Homebuyer June 25, 2021 Lutheran Social Services of Southern California

A conventional 97 mortgage is a type of conventional loan that helps first-time home buyers finance a single-family home with a low down payment. A conventional 97 loan lets eligible home buyers borrow up to 97% of the home's value with a down payment as low as 3%. To qualify, at least one borrower must be a first-time home buyer.

firsttimehomebuyerbookcover » The Stacking Benjamins Show

Get approved to buy a home. Our simplified loan process keeps first-time home buyers in mind. Start My Application. Based on Rocket Homes closed client surveys received from 2011-2020. We make it easy for first-time home buyers to understand what they can afford, research how to buy a home, calculate payments and apply online for a home loan.

Hi My Name is First Time Home Buyer.

The Fannie Mae HomeReady program is tailored for first-time home buyers with moderate incomes. HomeReady offers low down payments — as low as 3% — and you can even use money from gifts, grants.

First Time Home Buyer Top 5 Questions Sukh Law

New American Funding: Best for borrowers with nontraditional credit. Andrews Federal Credit Union: Best for military borrowers. Flagstar: Best for overall mortgage lending. PNC: Best for first.

Firsttime Homebuyer Program Miramar, FL

The Manitoba Metis Federation (MMF) will provide a one-time forgivable loan of up to $18,000 in Southern MB and $25,000 north of the 53rd parallel (including taxes) to provide for emergency home repairs and renovations to improve, adapt, and maintain existing housing stock. The amount was recently increased from $15,000 to $18,000 to respond to.

First Time Homebuyer Incentive Canadian Mortgage App

The FTHPP contributes funds to a first-time home purchase in the following ways: 5% of the home purchase price up to a maximum of $18,000.00 towards the down payment. 1.5% up to a maximum of $2,500.00 towards closing costs (legal, land transfer, etc.) To apply for this program, please visit the LRCC page.

FirstTime Home Buyer Guide Buying Process, Resources, Tools SoFi

Here are the programs first-time buyers use. 1. HomeReady: Low Down Payment Mortgage. HomeReady is a 3-percent down payment mortgage that offers reduced mortgage rates and lower loan costs for low- and moderate-income home buyers. HomeReady is a modified conventional mortgage, backed by Fannie Mae.

First Time Home Buyer Loan DeLand, Florida

Mr. Cooper. 620 for conventional loans, 580 for FHA loans, 600 for VA loans. 3% for conventional loans, 3.5% for FHA loans, none for VA loans. 4.6. Rocket Mortgage. 620 for conventional loans, 680.

First Time Home Buyer Letter to Seller, Home Offer Letter Template From Single Person. Dear

Types of first-time homebuyer programs. Low-down payment conventional loans: Conventional loan programs that require just 3 percent down. Down payment assistance (DPA) programs: Loans, grants and.

First Time Home Buyer Tips Video 1 of 3 YouTube

Step No. 3: Improve your credit, if needed. When you meet with a mortgage lender, the lender will pull your credit score. Although a perfect credit score is 850, all scores 760 and above are.

9 Tips for FIRSTTIME Homebuyers from Domii domii

save the minimum requirement to purchase their first home. Objectives of the MMF Housing Program: • To deliver a first time home buyer down payment program that is designed for Metis Citizens living in and urban rural communities across , using existing infrastructure andManitoba expertise.

Real Estate 101 For The FirstTime Homebuyer

The home purchase closing costs available under FTHPP grant will be 1.5% of the home purchase amount to a maximum of $2,500. Should the home purchase closing costs be more than $2,500., the excess amount will be the responsibility of the applicant(s); Legal costs (including fees and disbursement) Land transfer costs.

Remember To Make Your Home Buyers Plan Repayment By March 1st Millards Chartered Professional

Here are six first-time home buyer loans and programs that are worth exploring. FHA loans are government-insured mortgages that require as little as 3.5% down. VA loans are zero-down-payment loans.

The top 5 mistakes firsttime homebuyers make Timmins News

The First Time Home Buyers Programs is a $5-million fund administered by the LRCC on behalf of the MMF. Since its launch in February 2019, the First Time Homebuyers Program has: received over 650 inquiries from interested Métis Citizens; received 258 applications and approved 215 of them;

Types of First Time Home Buyer Loans Focus Federal Credit Union

PNC: Best for Ease of Access. Ally: Best for Fast Preapproval. LoanDepot: Best for Refinancing a First-Time Home-Buyer Loan. Bank of America: Best for Nationwide Availability. Guild Mortgage: Best.

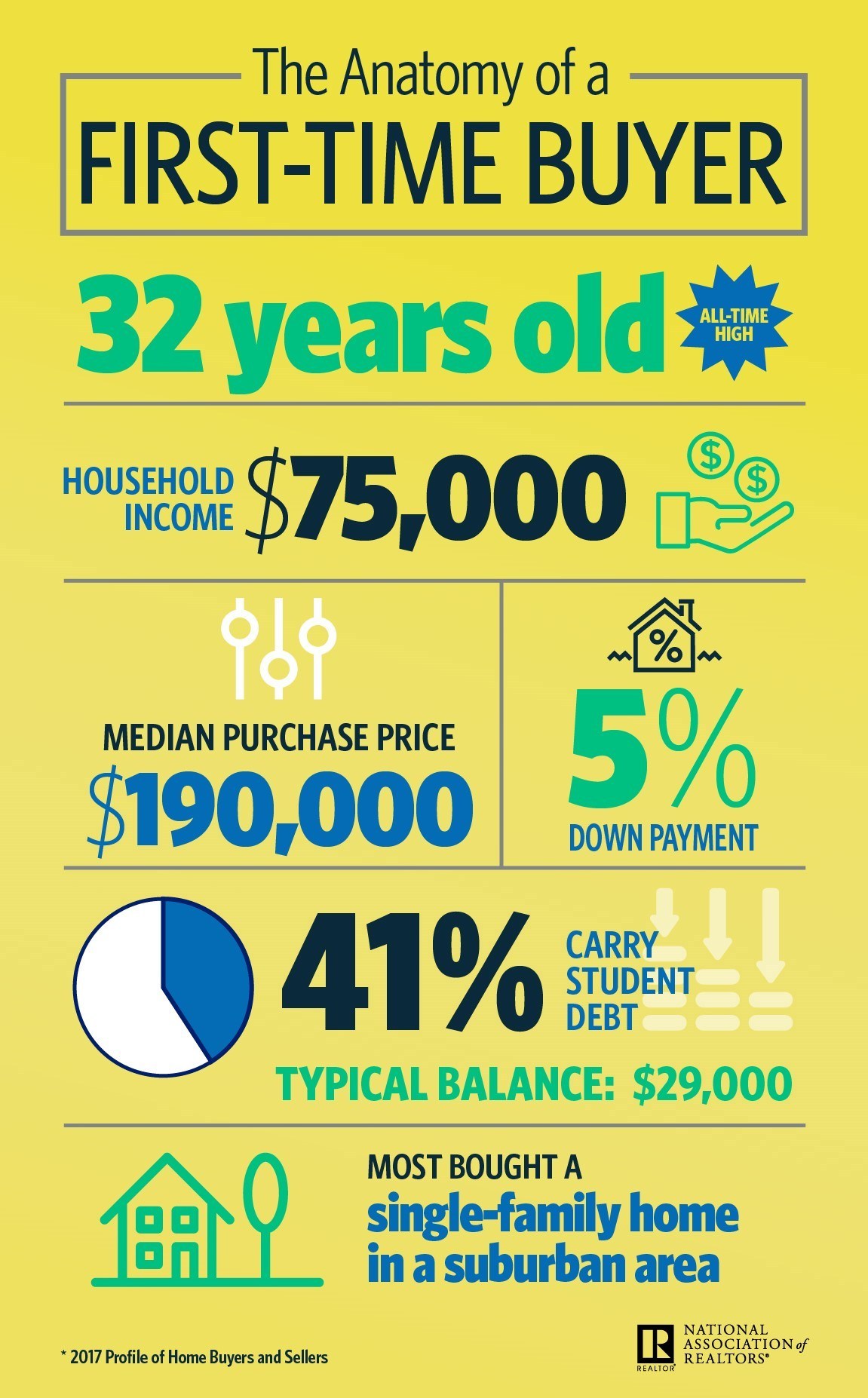

Infographic Breaking Down FirstTime Buyer Data RISMedia\'s Housecall

See all the first-time homebuyer programs available in the US in 2024. Learn about state-specific assistance, including down payment help, tax credits, and more.