How Do I Get An Ein Number For Sole Proprietorship Ethel Hernandez's Templates

To register as a sole proprietor or partnership, you may need to: register your business with the provinces and territories where you plan to do business; get a federal business number and tax accounts; apply for any permits and licences your business may need; Register with your province or territory. Most businesses need to register with the.

What does sole proprietorship registration online entail? by Issuu

To register with Ontario Business Central, the base fee to register a Sole Proprietorship is $145.88. The registration is completed on a same-day basis Monday thru Friday before 3:00 pm EST. Ontario Business Central has been assisting entrepreneurs to start their businesses since 1992, and we would be honoured to assist you in registering your.

How to Register a Business in Ontario (2023) StepByStep Guide for New Entrepreneurs

Help us improve our service. Take a 2-minute survey about your use of the Ontario Business Registry. Contact us by email if you have questions about signing up for the new Ontario Business Registry. Alternatively, you can call ServiceOntario at: Tel: 416-314-8880. Toll-free: 1-800-361-3223. TTY: 416-325-3408.

Ontario Sole Proprietorship Sample Canada Nuans Report

Once you're ready to register your sole proprietorship, you'll need to create a ONe-key account and a Service Ontario account. Then you'll be able to log into your Service Ontario account and register your business for a fee of $60. If you want to save money, time, and effort, you can register your sole proprietorship with Ownr for a one.

Sole Proprietorship 101 What it Is and How it Works Opstart

Here's how to start a sole proprietorship in seven steps: Step 1. Decide on a Business Name. Coming up with a business name can be exciting―it is a representation of you and the product or.

How to Register as a Sole Proprietor in Canada

Cons of a Sole Proprietorship in Ontario. Cost of Starting a Sole Proprietorship in Ontario. Starting a Sole Proprietorship in Ontario: Step-by-Step. Step 1: Brainstorm the basics. Step 2: Understand government requirements. How to register your sole proprietorship. Federal business number and tax accounts.

How to Register A Sole Proprietorship In Ontario Opstart Sole proprietorship, Business

A sole proprietorship business registration completed online through ServiceOntario costs $60. You may also need to pay for a business name search and report. For a corporation, the online application fee is $300. If you use Ownr to simplify the process, your sole proprietorship application costs $89, and incorporation costs $599.

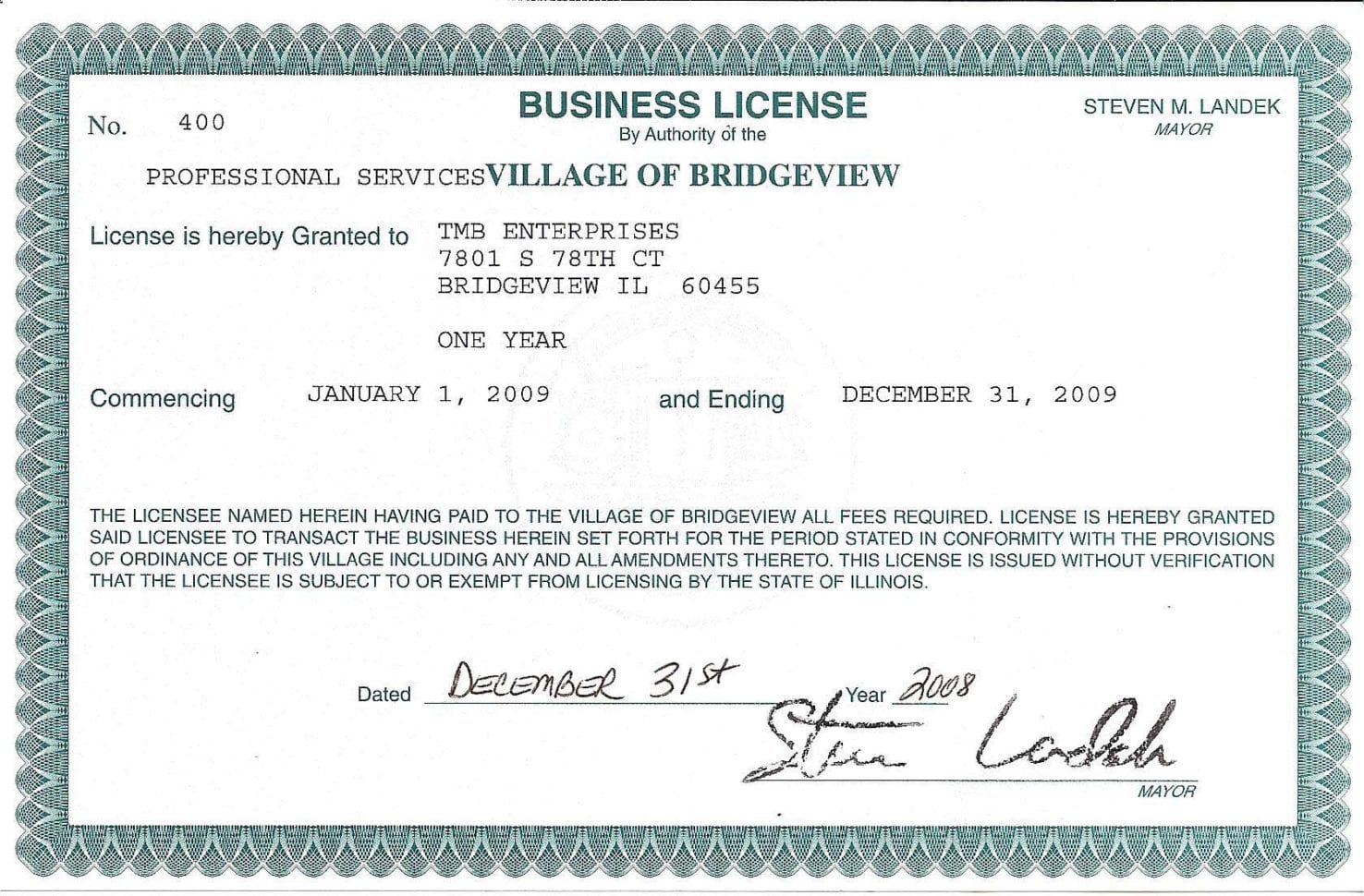

Business License Template Download

As a sole proprietor, if you expect to owe more than $1,000 in income tax from your business this year, you must make quarterly estimated tax payments to the IRS. Consult Form 1040-ES for full.

Ontario Business Name Registration (Master Business Licence) Nuans Canada

2. Registration required by law. Even if you are not concerned about someone using your business name, under the Ontario Business NamesAct, you are required by law to register it. If you do not register the name of your sole proprietorship, you may be fined up to $2,000. Further, the law requires that you register your business name unless you.

How to Start A Sole Proprietorship in California Step by Step Guide To Sole Proprietor YouTube

To learn about your registration requirements and start the registration process, choose your planned business type: Corporation (federal or provincial/territorial) Sole proprietorship or partnership; Cooperative; Get help with business registration. If you need help figuring out the business registration process you can access support by region.

How to start a sole proprietorship What you need to know IONOS

* For sole proprietorship registration, "Save $49" offer is inclusive of any applicable taxes, and for incorporation, "Save $300" offer is inclusive of any applicable taxes ("Offer"). Offer available when you register or incorporate with Ownr and apply and get approved for a new RBC business deposit account associated with the business.

Why You Should Use Ownr to Register Your Sole Proprietorship in Ontario Ownr

Registration for GST/HST. A sole proprietorship is an unincorporated business that is owned by one individual. It is the simplest kind of business structure. The owner of a sole proprietorship has sole responsibility for making decisions, receives all the profits, claims all losses, and does not have separate legal status from the business.

How To Renew A Sole Proprietorship In Ontario in 2021 Sole proprietorship, Renew, Business blog

You will need to register your sole proprietorship if you are not using your own name as your business name. If your business has employees, facilities, or offices in Ontario, you must register provincially. Partnerships. A partnership is a business owned by two or more people.

How To Register a Business in Ontario (Corporation & Sole Proprietorship)

Anyone who is 18 years old and operates a business in Ontario can register a Sole Proprietorship. You are NOT required to be a Canadian citizen or Permanent Resident and can be a landed immigrant or you can also live abroad as Sole Proprietor with an Ontario address for the business. For those who are in Canada on work visas, it is important to.

How to register a business QuickBooks

4. Register your business online. If your business has employees, facilities, or offices in Ontario, you must register using the Ontario Business Registry. 5. Confirm licences and permits. You may need licences and permits to run your business according to federal, provincial, or municipal regulations. 6.

Register a Firm Accounting Firms in Ontario

Ontario here. As far as I know registering as sole prop is as simple as registering the business name online (~$60) and getting a Master Business Number. You do not need to register an HST number until you cross the $30k threshold in a calendar year. However, that doesn't mean you don't have to. You can still do it now to save some headache later.